The Pradhan Mantri Fasal Bima Yojana (PMFBY) is a lead plan of the Indian government sent off in 2016. It means to offer monetary help to farmers in case of harvest disappointment because of regular disasters, nuisances, and sicknesses. This exhaustive protection conspire goes about as a security net, shielding farmers from monetary misfortunes and guaranteeing their vocation.

Key Points of PMFBY:

Img Src:-Vikaspedia

Inclusion:

PMFBY covers many yields, including food harvests, oilseeds, and business/green harvests.

Region Based Approach:

Dissimilar to conventional protection plans in light of individual ranch appraisal, PMFBY takes on an area-based approach. This disposes of expected predispositions and guarantees more extensive inclusion.

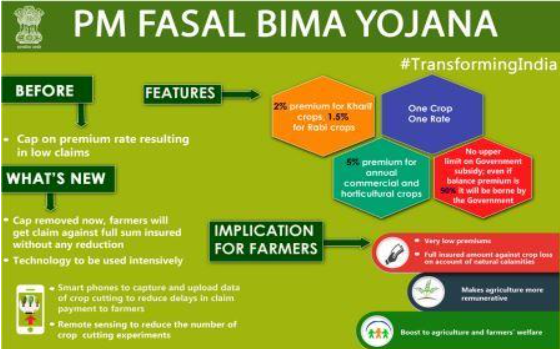

Low Charges:

Farmers contribute a negligible portion of the premium (1.5% to 5% of the aggregate guaranteed), while the excess sum is sponsored by the public authority. This makes the plan reasonable and open to even the most peripheral farmers.

Opportune Cases Settlement:

PMFBY underscores brief case settlement through direct exchanges to Farmers’ ledgers, limiting monetary pressure during troublesome times.

Straightforwardness and Innovation:

The plan use innovation for information assortment, guarantee handling, and complaint redressal, guaranteeing straightforwardness and proficiency.

Impact of Pradhan Mantri Fasal Bima Yojana:

Upgraded Hazard Alleviation:

PMFBY has given genuinely necessary monetary strength to a huge number of farmers, relieving the dangers related with horticulture and empowering them to put resources into worked on cultivating rehearses.

Further developed Food Security:

By decreasing the effect of harvest misfortunes, PMFBY has added to expanded food security in the country.

Monetary Incorporation:

The plan has carried numerous already unbanked farmers into the formal monetary framework, working with admittance to credit and other monetary administrations.

PMFBY and UPSC:

While PMFBY itself isn’t straightforwardly remembered for the UPSC prospectus, grasping its targets, execution, and effect on farmers’ lives can be significant for UPSC wannabes. It gives experiences into government strategies focused on country improvement and agrarian development, which are urgent parts of India’s financial scene.

PMFBY and CSCs:

Normal Help Places (CSCs) assume a crucial part in working with PMFBY enlistment for farmers in provincial regions. These focuses give farmers help with filling structures, getting to data, and tending to any questions they might have.

Img Src:- www.india.gov.in

How to Fill PMFBY Form and Register:

Farmers can sign up for PMFBY through their neighborhood CSC or Kisan Seva Kendra.

They need to give subtleties like landholding, crop planted, and credit subtleties (if any).

The top notch sum is determined in view of the picked crop, region planted, and aggregate guaranteed.

Farmers can pay their portion of the exceptional through cash or different computerized installment choices.

Upon effective enlistment, farmers get a strategy record with subtleties of their inclusion and guarantee settlement techniques.

The Pradhan Mantri Fasal Bima Yojana is a groundbreaking drive that has engaged large number of Indian farmers and reinforced the rural area. By giving monetary security and alleviating chances, PMFBY has worked on the existences of farmers and added to the general improvement of the country.

Keep in mind, PMFBY is a significant asset for farmers across India. By figuring out its advantages and profiting its administrations, farmers can safeguard themselves from monetary difficulty and prepare for a safer and prosperous future.

Click Here To Know Latest Schemes and Information

PMFBY FAQs: Protecting Your Farming Future

The Pradhan Mantri Fasal Bima Yojana (PMFBY) empowers millions of Indian farmers with financial security against crop loss. But navigating the scheme can raise questions. Let’s address some common FAQs:

1. What crops are covered under PMFBY?

A wide range of crops are covered, including food crops like rice, wheat, and pulses, oilseeds like mustard and soybean, and commercial/horticultural crops like cotton, sugarcane, and banana. You can find a complete list on the official PMFBY website.

2. How much does the insurance cost?

Farmers contribute a minimal share of the premium, ranging from 1.5% to 5% of the sum insured, depending on the crop and location. The remaining amount is subsidized by the government, making it highly affordable.

3. How do I file a claim if my crop fails?

Inform your local Gram Panchayat or Kisan Seva Kendra immediately after the crop loss. They’ll guide you through the claim process, which involves submitting necessary documents and undergoing field verification. Claims are typically settled through direct bank transfers within a set timeframe.

4. Can I register for PMFBY online?

Currently, enrollment happens primarily through your local Common Service Center (CSC) or Kisan Seva Kendra. However, some states are piloting online registrations, so check with your local authorities for updates.

5. What documents do I need to enroll in PMFBY?

You’ll need documents like landholding records, Aadhaar card, bank account details, and details of the crop sown. The CSC or Kisan Seva Kendra can assist you in gathering and filling the form.

6. Does PMFBY cover all types of crop failure?

The scheme covers losses due to natural calamities like drought, floods, and hailstorms, as well as pests and diseases notified by the government. However, deliberate neglect of the crop or losses due to non-notified pests and diseases are not covered.

7. Who can help me if I have further questions about PMFBY?

You can reach out to your local CSC or Kisan Seva Kendra for assistance. They can answer your questions and guide you through the enrollment and claim process. You can also contact the PMFBY helpline at 1800-180-1516 or visit the official website (https://pmfby.gov.in/) for information and FAQs.

Remember, PMFBY is a valuable resource for protecting your agricultural livelihood. By understanding its benefits and enrolling in the scheme, you can navigate challenges with greater confidence and build a more secure future.

We hope these FAQs have cleared your initial doubts about PMFBY. Don’t hesitate to ask if you have any further questions!