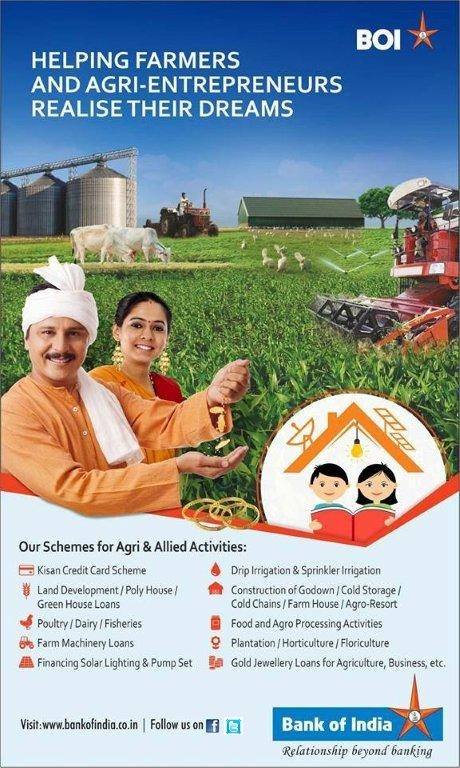

Bank of India has recently introduced game-changing festive offers aimed at empowering farmers and agri-entrepreneurs with hassle-free financial solutions. The bank’s new initiatives, namely Farm Mechanization and Krishi Vahaan, are set to revolutionize the agricultural financing landscape, providing much-needed support to this crucial sector. These schemes, running until 31st March 2024, are designed to address the key challenge faced by farmers and agri-entrepreneurs – access to essential financial aid.

Farm Mechanization and Krishi Vahaan Schemes

The Farm Mechanization and Krishi Vahaan schemes offer a seamless term loan solution for financing various agricultural essentials, including farm machinery, implements, and transport vehicles. The Krishi Vahaan loan, in particular, covers up to 90% of the ex-showroom price of the vehicle and requires no collateral for loans up to INR 25 lakh for farmers and up to INR 1 crore for agri-entrepreneurs. On the other hand, loans for farm machinery are available up to 85% of the cost.

Features of Krishi Vahaan

The Krishi Vahaan scheme offers several standout features, including an attractive interest rate, loan coverage up to 90% of the vehicle’s ex-showroom price, and no collateral requirement for loans up to Rs. 25.00 lakh for farmers. The documentation process is hassle-free, with instant approval of the loan and attractive incentives for vehicle dealers under a tie-up arrangement.

Features of Farm Mechanization

Similarly, the Farm Mechanization scheme offers longer repayment terms, an attractive rate of interest, and no collateral requirement for loans up to Rs. 1.60 lakh. Loans are available up to 85% of the cost of new machinery, making it a highly beneficial scheme for farmers and agri-entrepreneurs looking to invest in modernizing their agricultural practices.

Krishi Vahaan – Key Features

- Attractive interest rate

- Loan available up to 90% of the ex-showroom price of the vehicle

- No collateral for loans up to Rs. 25.00 lakh for Farmers

- Hassle-free documentation

- Instant approval of the loan

- Attractive incentive/payout available for vehicle dealers under a tie-up arrangement

Farm Mechanization – Key Features

- Longer repayment terms

- Attractive rate of interest

- No collateral for loans up to Rs. 1.60 lakh

- Loan available up to 85% of the cost of new machinery

Bank of India’s Commitment to Empowerment

These initiatives by Bank of India underscore its dedicated effort to provide accessible and efficient financial solutions to farmers and agri-entrepreneurs, empowering them to navigate the challenges of modern agriculture with confidence. Moreover, this commitment aligns with Prime Minister Narendra Modi’s vision to increase farm income and enhance productivity, making it a significant step towards a more prosperous agricultural future.

Benefits and Conveniences of the Schemes

What sets these schemes apart are the tangible benefits they offer, including no hidden charges, a straightforward documentation process, and quick disbursal of loans. The application process is simplified, making it easier for farmers and agri-entrepreneurs to access the financial aid they need to grow their businesses.

Click Here For More Interesting News

In conclusion, Bank of India’s festive offers on the Farm Mechanization and Krishi Vahaan schemes are set to revolutionize the agricultural financing landscape, providing much-needed support to farmers and agri-entrepreneurs. These schemes, with their attractive features and benefits, are a testament to the bank’s commitment to the agricultural sector, ultimately contributing to its growth and prosperity.

FAQ

- Are these schemes available only to existing Bank of India customers?

- No, these schemes are open to both existing and new customers of Bank of India.

- What is the application process for these loans?

- The application process is simple and straightforward. Interested individuals can visit their nearest Bank of India branch for more information.

- Is there a deadline to apply for these schemes?

- Yes, these festive offers are set to run until 31st March 2024.

- Can these loans be used to purchase used farm machinery or vehicles?

- No, these loans are specifically for new farm machinery and vehicles.

- Are there any penalties for early repayment of these loans?

- No, there are no penalties for early repayment of these loans, allowing borrowers to save on interest costs.